Air New Zealand is a quality brand. I like their in-flight snacks, don’t mind paying slightly more for their reputation of reliability compared to their domestic route competitor JetStar, and I appreciate their creative safety videos and the fact they are slightly more interesting to watch multiple times.

Then there is POLi. POLi sounds friendly.

If you can use POLi, it saves you from Air New Zealand’s excessive credit card surcharge fees by letting you use a bank transfer to pay for flights. You can’t use it if you’re in New Zealand and have a Mac. This rules me out. Apparently the Australian POLi now works with Macs fine.

ASB and BNZ </3 POLi

Last year banks started warning against using POLi because how it operates to verify you are actually paying Air New Zealand and friends is a bit suspicious.

Interestingly, Air New Zealand isn’t even listed in that Stuff article, even though they’re likely the biggest company using POLi in New Zealand, and are featured on POLi’s website.

Providing your log in details to a third party will be in violation of the internet banking terms and conditions you’ve agreed to, and potentially opens you up to being liable for losses.

There is the possibility of an additional motive going on here: banks sell credit and debit cards, and those cards make them money. POLi is quite an attractive alternative because it saves you something like $8 on a return domestic flight.

Air New Zealand’s Surcharging

This surcharging is extortive, misleading, and unlike airplanes that come on time, Peter Jackson spoofs, and free-but-not-really-free cookies, doesn’t endear Air New Zealand to me. Especially on domestic flights.

It’s presented as a transaction charge to recover costs (“Air New Zealand needs to recover this cost”), but it gets charged multiple times in the same card transaction. When I pointed this out to Air New Zealand they ignored me.

Air New Zealand pay something to accept credit cards, but that is not $4 per person flying, per direction they are flying. Instead of passing on the percentage they are actually charged, which Bernard Hickey’s industry experts say would be less than 1%, they charge a fixed fee multiple times in the same card transaction.

A group booking shows how ridiculous this gets. I once flew with a dozen or so people, and each person was charged $4 there, and $4 back, even though the flights were booked over just two transactions. To their credit Air New Zealand refunded close to $100 of fees after I called them.

Air New Zealand even issued a press release in 2008 chastising Pacific Blue for, among other things, their $4 per sector card surcharge because Pacific Blue offered no alternative payment. Kind of like what Air New Zealand does to Mac users. Or what they do to anyone following the advice of banks. (I’m ignoring Airpoints and Travelcard as payment methods because they aren’t accessible forms of payment for a lot of people.)

The ComCom have “investigated” the matter, concluding that the “card payment fee is used to recover all of the direct and indirect costs associated with credit cards payments.” The key word here being indirect, I think.

To be fair to Air New Zealand, JetStar charges $5 per flight for card transactions, but let’s be honest, JetStar are a hot mess, and Australian, and you shouldn’t be booking with them anyway.

Either way, it’s interesting to see these surcharges creep up over time, for cost recovery purposes, I’m sure. Are the airlines poor negotiators when it comes to their merchant agreements? I wouldn’t think so.

To quote ex-Air New Zealand Chief Operating Officer Andrew Miller: “research feedback shows customers are keen for… one easy to understand price with no added levies to the fare”.

Tomorrow: Ticketek, Ticketmaster and their fees (including the emailing-you-a-PDF surcharge). Maybe. Probably not.

- ASB’s security alerts (18/19 December 2012, cached)

- BNZ’s updated security alert (did both banks have to update their alerts after being threatened with legal action by POLi?)

- Bernard Hickey on credit card surcharges and the ComCom

Image credit: me

A group of researchers have published a very interesting paper:

A group of researchers have published a very interesting paper:

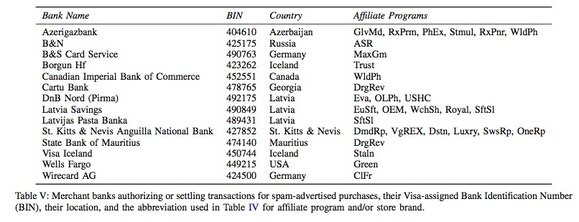

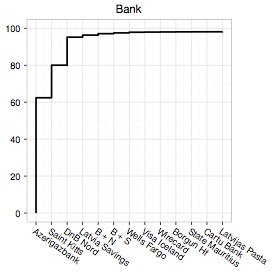

The researchers say that the banking/payment component of the spam value chain is the most critical. Payment infrastructure has “far fewer alternatives and far higher switching cost”.

The researchers say that the banking/payment component of the spam value chain is the most critical. Payment infrastructure has “far fewer alternatives and far higher switching cost”.

National’s involvement

National’s involvement